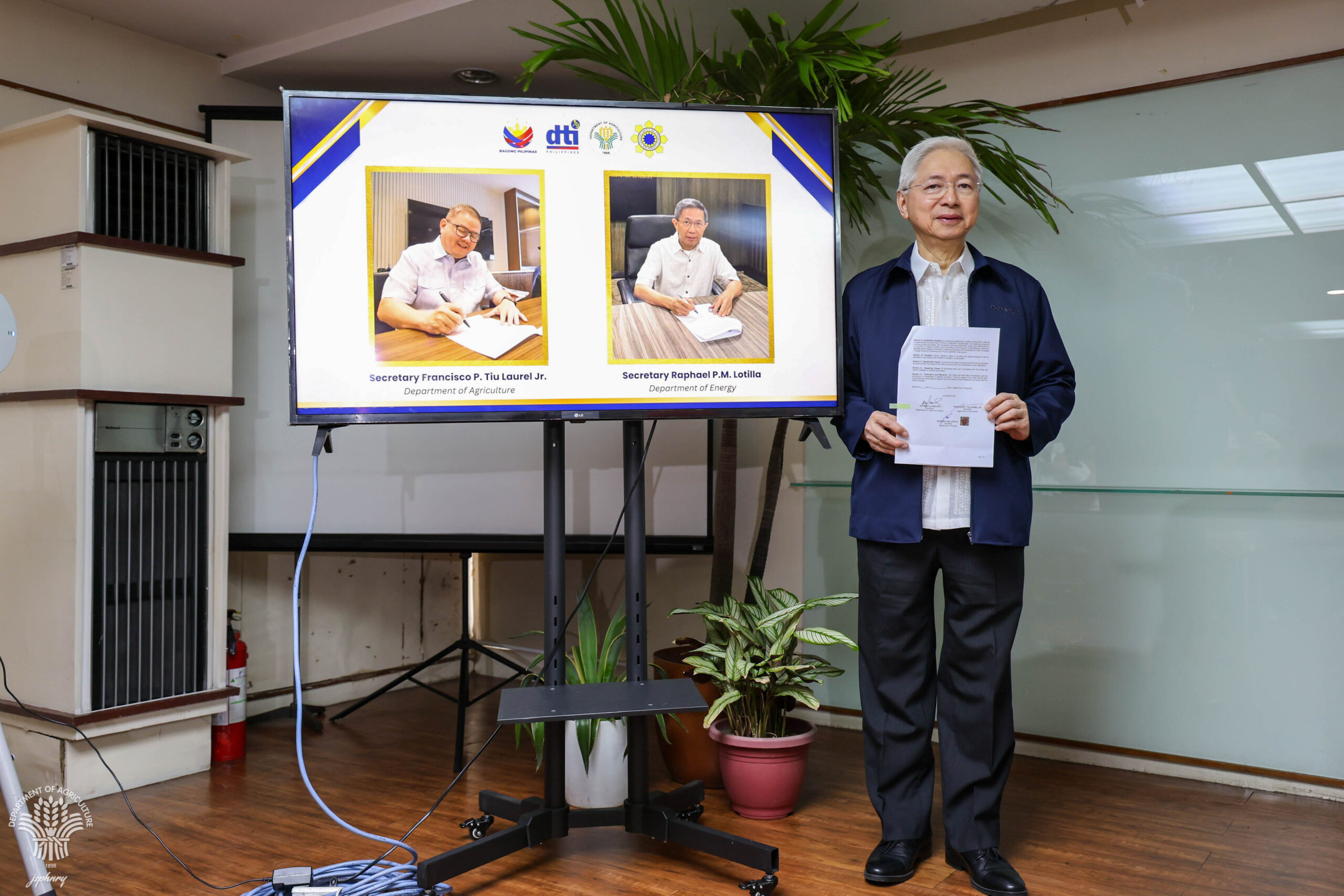

The Department of Agriculture (DA), Department of Trade and Industry (DTI), and Department of Energy (DOE) signed a joint administrative order (JAO) implementing a special discount of five percent of the regular retail price of basic necessities and prime commodities (BNPC) without exemption from the value-added tax (VAT) for Filipino senior citizens and persons with disabilities (PWDs).

According to the JAO, signed on March 21, 2024, the total amount of the discount shall not exceed P125 per week for an equivalent total maximum purchase of P2,500 per week. This should be spent on at least four different kinds of locally manufactured and locally produced BNPCs as identified by the JAO.

Recognized as basic necessities by the JAO are: all kinds and variants of rice (except imported specialty rice); all kinds and variants of corn; all kinds of locally produced bread (cakes and pastries not included); all locally produced fresh, dried, and canned fish and other marine products (including those live, chilled, frozen, and in various modes of packaging); all locally produced fresh pork, beef, and poultry meat (except premium grade); all fresh chicken and duck eggs; locally manufactured potable water in bottles and containers regardless of size; fresh and processed milk (excluding foods for special medical purposes); locally produced fresh vegetables including root crops; all kinds of fresh fruits; locally manufactured instant noodles; locally produced coffee (only whole beans, ground beans, instant up to three main ingredients); all kinds of sugar (except artificial sweeteners); cooking oil (only coconut oil, palm oil, soybean oil, canola oil, and vegetable oil); iodized salt; locally manufactured laundry and detergent soap; locally produced firewood; locally manufactured charcoal; all kinds of candles (except decorative and scented); household liquefied petroleum gas (LPG) with a net content of not more than 11 kilograms (only once every five months) bought from LPG dealers; and kerosene not exceeding two liters per month.

Meanwhile, prime commodities covered under the JAO include: all kinds of flour; all locally manufactured dried, processed, and canned pork, beef, and poultry meat; all kinds of locally manufactured dairy products that are not considered as basic commodity; all kinds of onion and garlic; locally manufactured vinegar, fish sauce, and soy sauce (except spiced); all kinds of toilet or bath soap; fertilizer; pesticides; herbicides; poultry feeds, livestock feeds, and fishery feeds; veterinary products; pad paper and school supplies; nipa shingle; sawali; cement, clinker, and galvanized iron sheets; hollow blocks; plywood; plyboard; construction nails; batteries (single-use household batteries); electrical supplies and light bulbs; and steel wires.

“Napakaimportante nito dahil gusto nating mabigyan ng welfare ang mga senior citizen sa mga item na hindi covered ng 20% SC discount,” said DTI Secretary Alfredo Pascual.

Establishments registered under the Barangay Micro Business Enterprises (BMBEs) Act of 2002 as well as cooperatives registered with the Cooperative Development Authority (CDA) are exempted from granting the special five percent discount.

“In terms of the KADIWA project ng DA, marami ritong farmers’ cooperatives na nagpa-participate. Hindi sila covered sa five percent discount kasi kung tutuusin, ang products natin sa KADIWA ay mas mababa ang price as compared to the regular,” DA Assistant Secretary for Consumer Affairs and Legislative Affairs Atty. Genevieve Velicara-Guevarra clarified.

The DA official, however, reiterated that the agriculture department fully supports the JAO by actively participating in the crafting of new provisions and amendments as well as recommending to highlight locally produced BNPCs.

“We took to heart ‘yong pag-highlight ng locally produced basic necessities and prime commodities para mas tangkilikin ng ating mga mamimili—hindi lamang ng mga senior citizen at PWDS—ang ating local produce,” Asec. Guevarra said.

Following the “No Double Discount” clause of the JAO, the special five percent discount cannot be used in conjunction with promotional discounts by establishments nor with the 20 percent discount under the Republic Act No. 9994 or the Expanded Senior Citizens Act of 2010 and the Republic Act No. 9442 or the Magna Carta for Disabled Persons and For Other Purposes. Also, unused discounts will not be carried over to the succeeding weeks.

To avail of the special five percent discount, the senior citizen must present their Senior Citizen Card, PWD ID, or any government-issued identification card along with their purchase booklet.

In the case of a representative purchasing on behalf of a senior citizen or a PWD, the representative should also present their government-issued ID and an authorization letter with a seven-day validity period to be eligible for the said discount.

The discount will also be available for online purchases, with the establishments being expected to formulate and implement their own systems on how to verify the customers’ eligibility for the discount.

Those who will be caught in violation of the JAO shall be punishable in accordance with the Expanded Senior Citizens Act and the Magna Carta for Disabled Persons. ### (Krystelle Ymari A. Vergara, DA-AFID)